Some Of Matthew J. Previte Cpa Pc

Some Of Matthew J. Previte Cpa Pc

Blog Article

4 Simple Techniques For Matthew J. Previte Cpa Pc

Table of ContentsThe smart Trick of Matthew J. Previte Cpa Pc That Nobody is DiscussingFascination About Matthew J. Previte Cpa PcThe smart Trick of Matthew J. Previte Cpa Pc That Nobody is Talking AboutMatthew J. Previte Cpa Pc Can Be Fun For EveryoneThe Facts About Matthew J. Previte Cpa Pc UncoveredTop Guidelines Of Matthew J. Previte Cpa Pc

Tax obligation regulations and codes, whether at the state or federal level, are as well made complex for a lot of laypeople and they alter as well typically for several tax obligation professionals to maintain up with. Whether you simply need someone to aid you with your organization income taxes or you have actually been billed with tax obligation fraudulence, hire a tax obligation attorney to help you out.

Matthew J. Previte Cpa Pc Things To Know Before You Buy

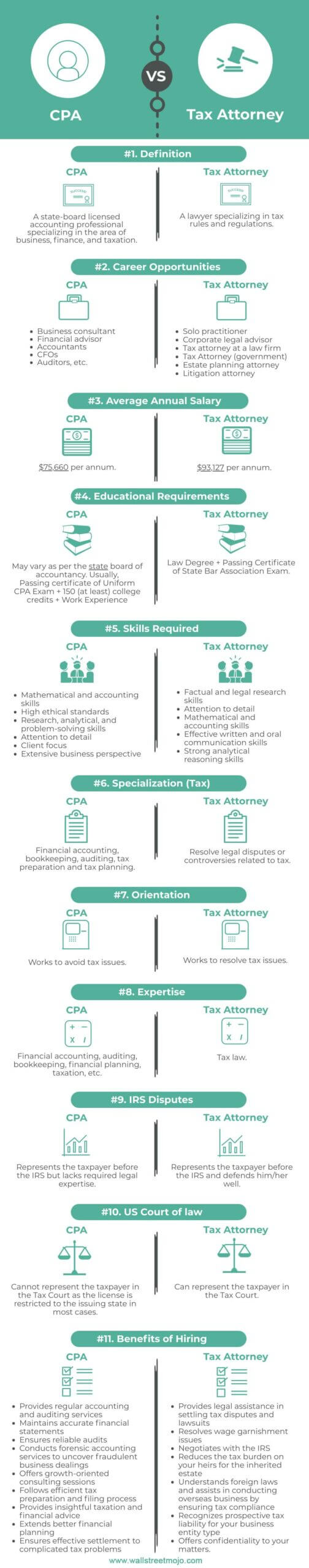

Every person else not just disapproval taking care of taxes, yet they can be straight-out scared of the tax obligation companies, not without reason. There are a couple of concerns that are always on the minds of those who are managing tax obligation problems, including whether to work with a tax obligation attorney or a CERTIFIED PUBLIC ACCOUNTANT, when to work with a tax obligation lawyer, and We intend to assist answer those questions here, so you know what to do if you locate yourself in a "taxing" scenario.

A lawyer can represent customers prior to the IRS for audits, collections and charms but so can a CERTIFIED PUBLIC ACCOUNTANT. The big difference below and one you need to remember is that a tax attorney can supply attorney-client benefit, indicating your tax obligation legal representative is exempt from being obliged to affirm versus you in a court of regulation.

The smart Trick of Matthew J. Previte Cpa Pc That Nobody is Talking About

Or else, a CPA can testify versus you even while helping you. Tax obligation lawyers are a lot more knowledgeable about the various tax obligation settlement programs than many CPAs and recognize just how to choose the finest program for your case and just how to obtain you qualified for that program. If you are having a problem with the internal revenue service or just concerns and issues, you need to hire a tax obligation attorney.

Tax obligation Court Are under investigation for tax obligation fraud or tax obligation evasion Are under criminal investigation by the IRS An additional essential time to hire a tax obligation lawyer is when you get an audit notice from the internal revenue service - tax attorney in Framingham, Massachusetts. https://www.nulled.to/user/6090531-taxproblemsrus. A lawyer can interact with the internal revenue service in your place, exist during audits, assistance bargain negotiations, and maintain you from overpaying as an outcome of the audit

Part of a tax obligation attorney's duty is to maintain up with it, so you are shielded. Ask around for an experienced tax obligation attorney and examine the web for client/customer reviews.

Matthew J. Previte Cpa Pc Fundamentals Explained

The tax lawyer you have in mind has all of the ideal qualifications and testimonies. Should you hire this tax lawyer?

The decision to employ an IRS attorney is one that must not be ignored. Lawyers can be incredibly cost-prohibitive and make complex issues unnecessarily when they can be settled relatively quickly. As a whole, I am a big supporter of self-help lawful remedies, particularly given the range of informative product that can be located online (including much of what I have actually released when it come to tax).

The Matthew J. Previte Cpa Pc PDFs

Right here is a quick checklist of the matters that I think that an IRS lawyer should be hired for. Allow us be totally sincere momentarily. Crook charges and criminal investigations can ruin lives and lug really significant consequences. Anyone who has spent time behind bars can load you in on the facts of jail life, however criminal costs often have a a lot more corrective impact that lots of individuals fall short to take into consideration.

Criminal fees can also carry extra civil fines (well beyond what is regular for civil tax matters). These are just some instances of the damage that even just a criminal cost can bring (whether or not a successful sentence is inevitably acquired). My factor is that when anything possibly criminal develops, also if you are just a prospective witness to the issue, you require a seasoned internal revenue service lawyer to represent your passions versus the prosecuting agency.

Some might quit brief of absolutely nothing to obtain a sentence. This is one circumstances where you constantly need an internal right here revenue service attorney watching your back. There are many parts of an IRS attorney's task that are relatively regular. Many collection matters are handled in about similarly (even though each taxpayer's scenarios and goals are different).

Matthew J. Previte Cpa Pc - An Overview

Where we earn our stripes however is on technological tax matters, which placed our full ability established to the test. What is a technical tax obligation issue? That is a hard inquiry to address, yet the finest way I would certainly describe it are issues that require the professional judgment of an internal revenue service attorney to deal with properly.

Anything that has this "fact dependence" as I would call it, you are mosting likely to wish to generate a lawyer to seek advice from - tax lawyer in Framingham, Massachusetts. Also if you do not retain the services of that lawyer, an expert perspective when dealing with technical tax obligation issues can go a lengthy way toward comprehending issues and fixing them in an ideal manner

Report this page